Inherited ira rmd calculator

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. The account balance as of December 31 of the previous year.

Required Minimum Distributions Tax Diversification

If youve inherited an IRA andor other types of retirement accounts the.

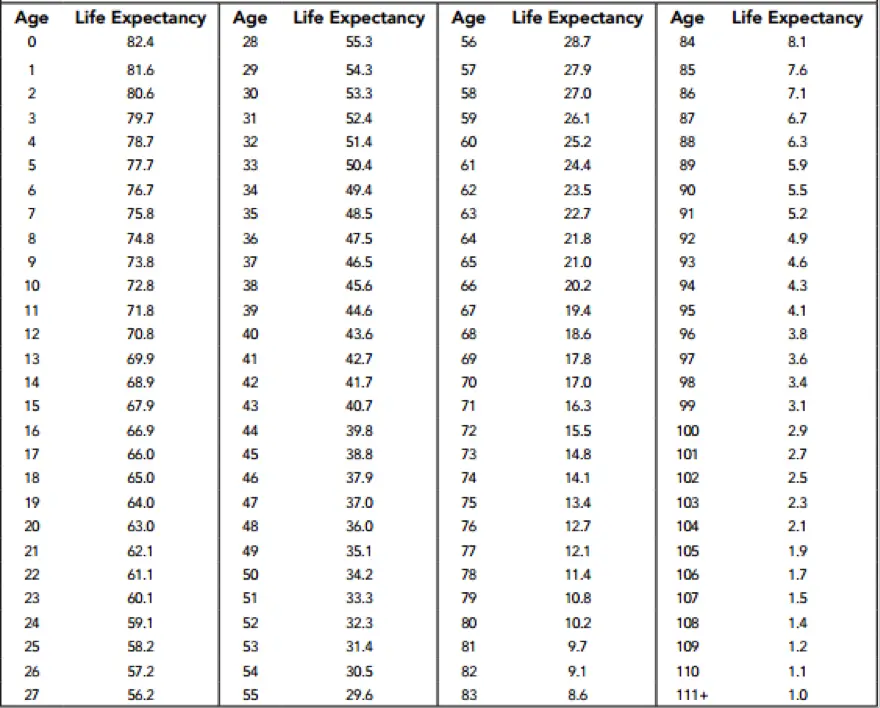

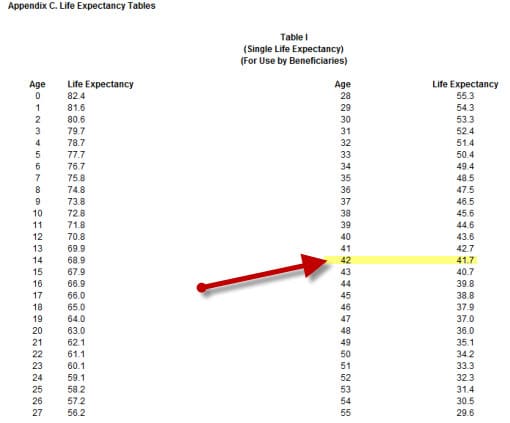

. Calculate the required minimum distribution from an inherited IRA. Distribute using Table I. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs.

Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. You can also explore your IRA beneficiary withdrawal options.

For assistance please contact 800-435-4000. Inherited RMD calculation methods The date of death of the original IRA owner and the type of beneficiary will determine what distribution method to use. You must take an RMD for the year.

RMD amounts are based on your age and are recalculated each year based on factors in the IRS. If you want to simply take your. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account.

Yes Spouses date of birth Your Required Minimum. Inherited IRA RMD Calculator - powered by SSC Inherited IRA Distribution Calculator Determine the required distributions from an inherited IRA The IRS has published new Life Expectancy. Inherited IRA RMD Calculator How much are you required to withdraw from your inherited retirement account s.

Get The Flexibility Visibility To Spend W Confidence. This calculator is undergoing maintenance for the new IRS tables. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. Did you inherit a retirement account. Inherited IRA RMD calculator For those who inherited an IRA due to the death of the original account holder.

Get Up To 600 When Funding A New IRA. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Access Schwab Professionals 247.

Ad Use This Calculator to Determine Your Required Minimum Distribution. Explore Choices For Your IRA Now. Calculate your earnings and more.

Paying taxes on early distributions from your IRA could be costly to your retirement. Get Up To 600 When Funding A New IRA. Aka Minimum Required Distribution Calculator This calculator determines the minimum required distribution known as both RMD or MRD which is really confusing from an inherited IRA.

Ad Explore Your Choices For Your IRA. Even though you must calculate each account individually you can take your total RMD amount from one account or many. Determine beneficiarys age at year-end following year of owners.

The inherited RMD is different for everyone depending on several factors such as IRA type IRA owners date of birth and death who the beneficiary is beneficiarys date of birth and the IRA. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. Calculate your traditional IRA RMD Your date of birth Account balance as of 1231 of last year Is your spouse the primary beneficiary.

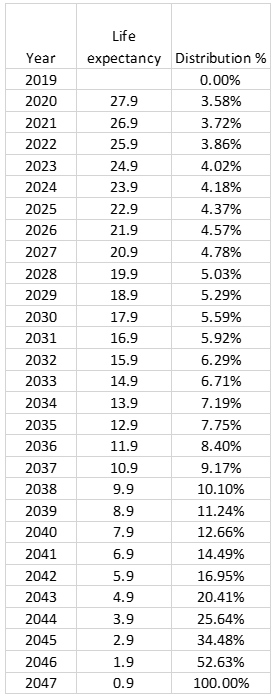

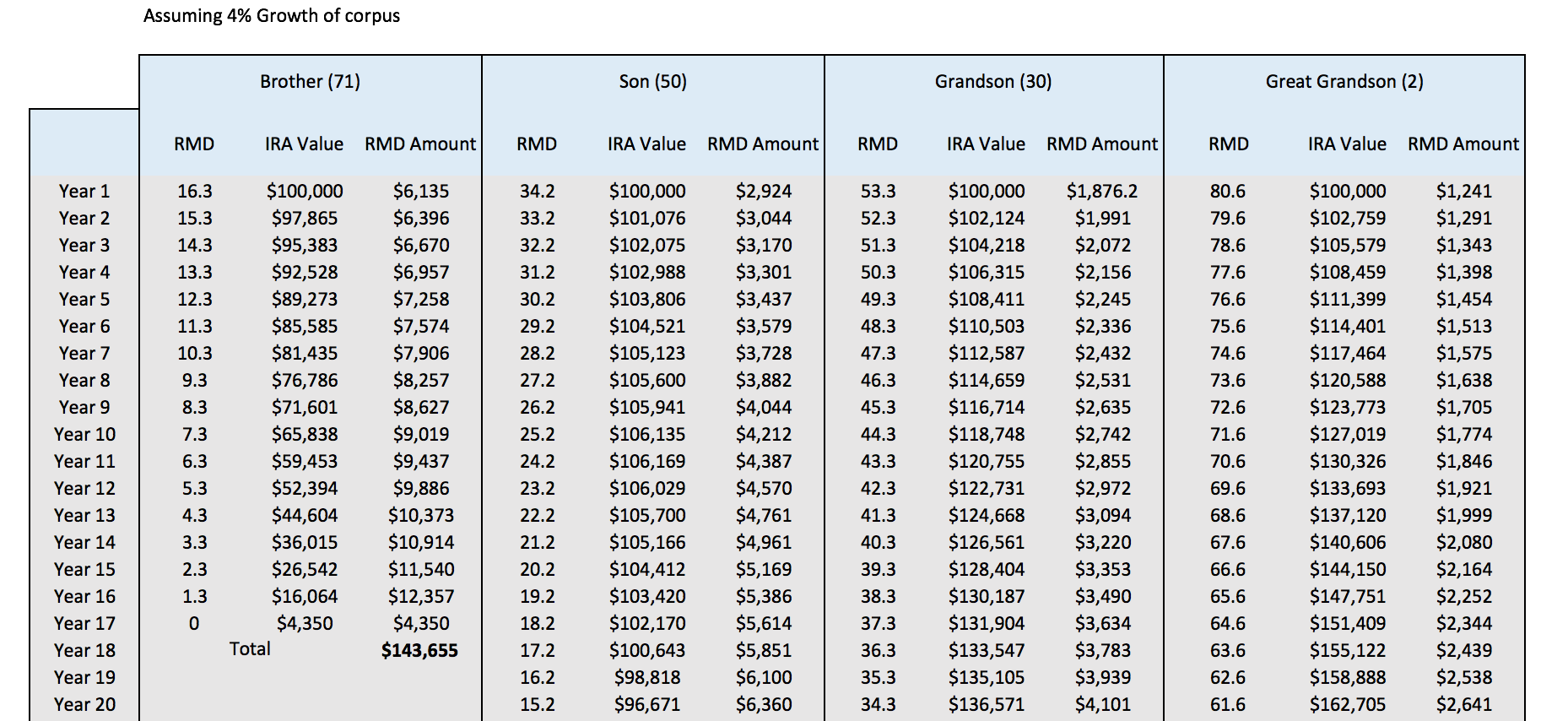

Run the numbers to find out. RMD amounts depend on various factors such as the beneficiarys age type of beneficiary and the account value. RMDs for Inherited IRAs are calculated based on two factors.

If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required. Beneficiary RMD Calculator Beneficiaries of a retirement plan can choose to keep the assets in a tax-deferred inherited IRA account. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. If you are age 72 you may be subject to taking annual withdrawals known as. If inherited assets have been transferred into an inherited IRA in your name.

If you are a beneficiary of a. As a beneficiary you may be required by the IRS to take. If you move your money into an inherited IRA you withdraw RMDs based on your age.

How To Calculate RMD For Inherited IRAs. Estimate annual minimum withdrawals you may be responsible to take from your inherited IRA using an inherited IRA RMD calculator from MetierEX.

Calculating The Required Minimum Distribution From Inherited Iras Morningstar

After Death Required Minimum Distribution Rules After The Secure Act Dbs

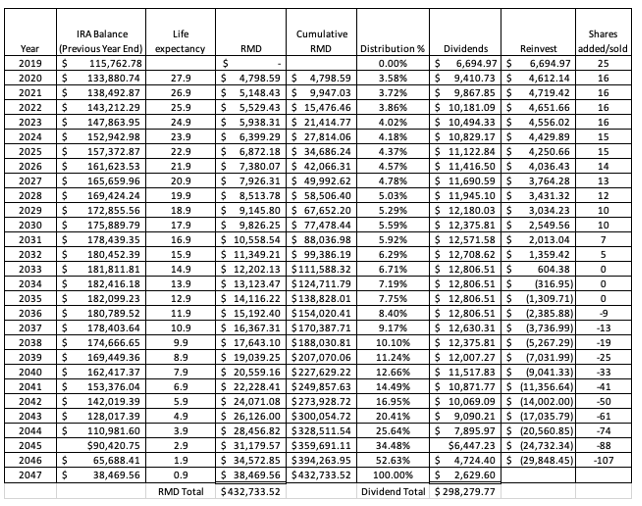

The Inherited Ira Portfolio Seeking Alpha

Avoid This Rmd Tax Trap Kiplinger

After Death Required Minimum Distribution Rules After The Secure Act Dbs

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Required Minimum Distributions Rules Heintzelman Accounting Services

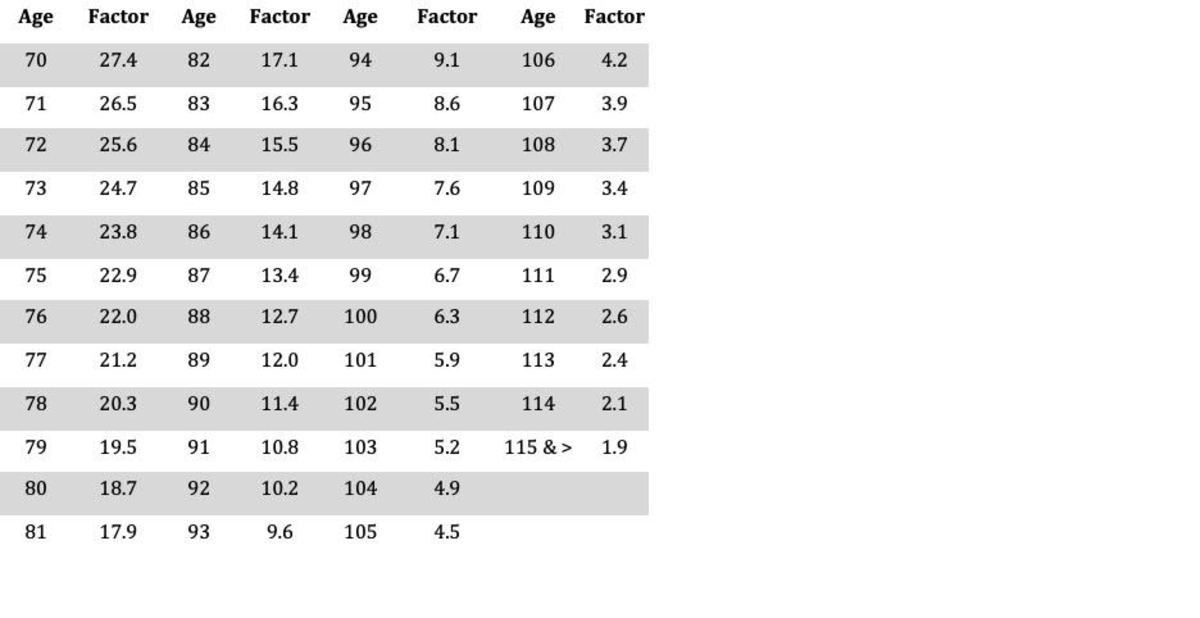

Sjcomeup Com Rmd Factor Table

The Inherited Ira Portfolio Seeking Alpha

Rmd Tables

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Be Aware Of Tsp Spousal Beneficiary Rules Fedsmith Com

Sjcomeup Com Rmd Distribution Table

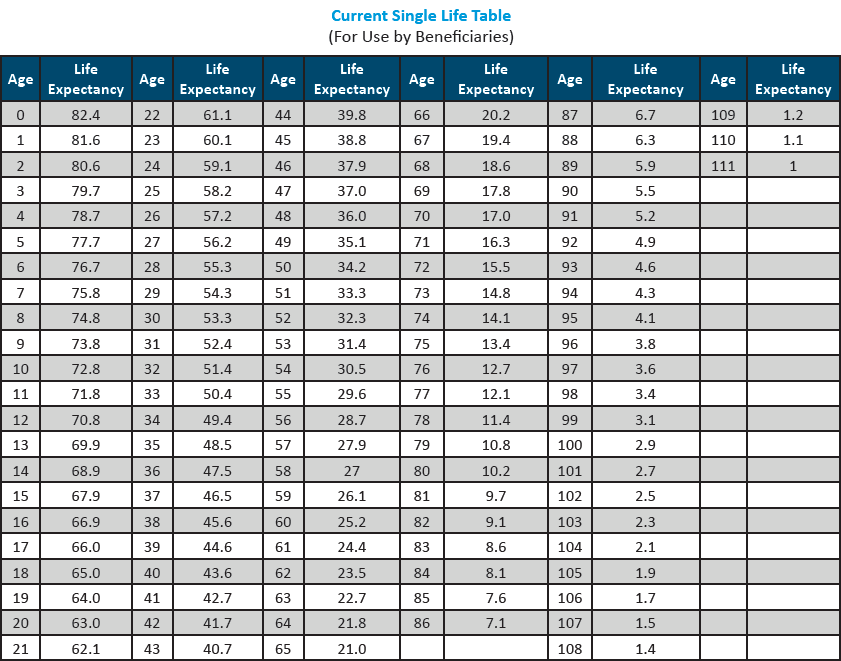

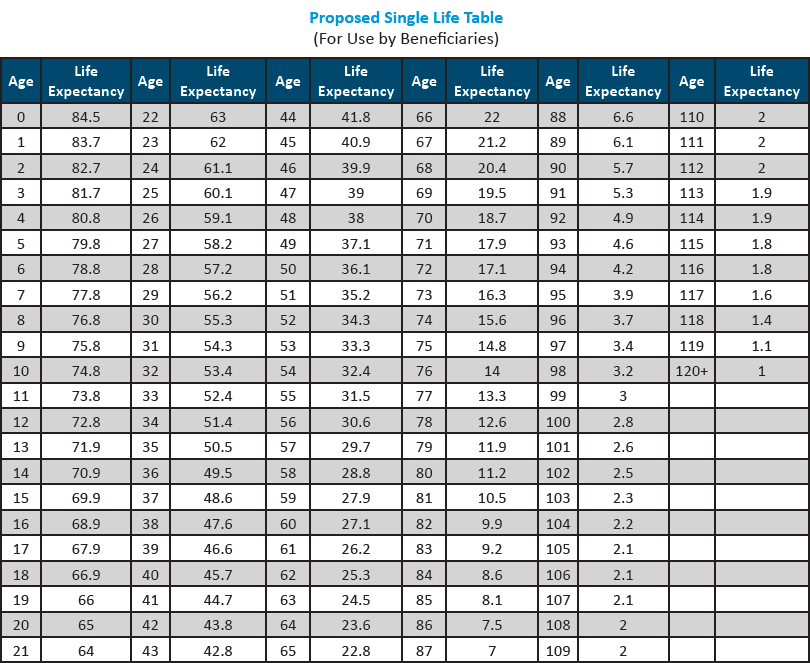

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Rmd Tables

Mandatory Ira Withdrawals The Elder Law Firm Of Robert Clofine

Rmds Tis The Season For Required Minimum Distributions